Volatility-Based Day Trading: What Works and What Doesn’t

Volatility is the lifeblood of day trading. The bigger the price swing, the more opportunity there is for quick profits—but also for sudden losses. Many traders are drawn to volatile stocks, hoping to ride sharp intraday moves. Yet few succeed without a system.

In this guide, we’ll break down what works and what doesn’t when it comes to volatility-based day trading—from strategy selection to risk management.

What Is Volatility-Based Day Trading?

Volatility-based day trading focuses on stocks or assets that move significantly during the day—typically 4–10% or more. Traders look for:

- Intraday breakouts

- News-driven spikes

- Gaps followed by continuation

- Range expansions after consolidation

Unlike swing trading, these positions are usually closed by the end of the session.

What Works in Volatility-Based Day Trading

✅ 1. Using VWAP as a Trend Filter

The Volume Weighted Average Price (VWAP) helps you:

- Identify bullish (above VWAP) vs. bearish (below VWAP) conditions

- Confirm breakout strength

- Avoid fading strong trends

Strategy Tip: Look for pullbacks to VWAP in trending stocks for clean entries.

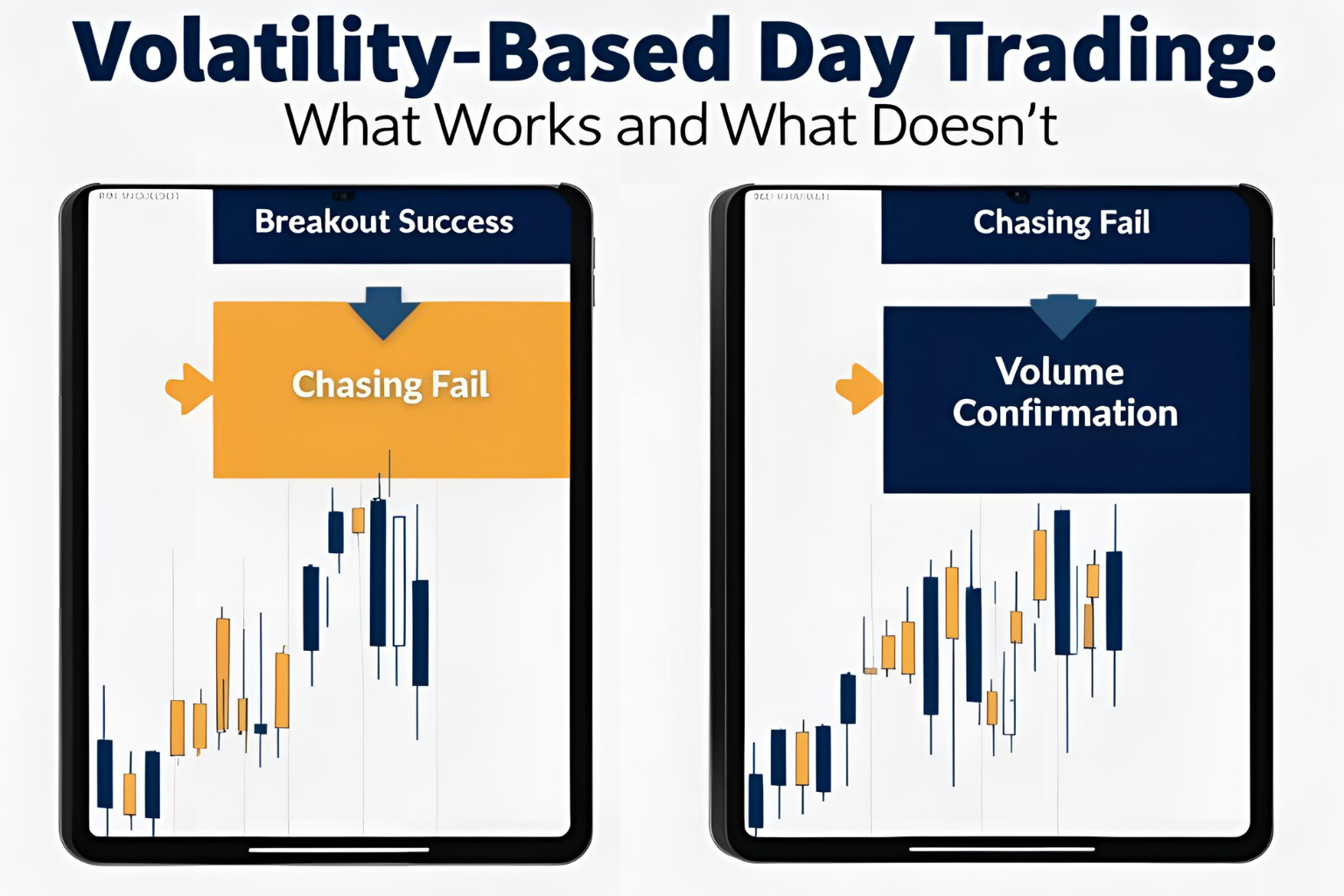

✅ 2. Opening Range Breakouts (ORB)

The first 15–30 minutes set the tone. If a volatile stock breaks out of its range with strong volume, it can run for hours.

Entry Plan:

- Wait for the range to form

- Buy on breakout + volume surge

- Stop-loss just below the range

Works Best: With a clear catalyst and strong relative volume.

✅ 3. Scanning for High Relative Volume

Relative Volume (RVOL) > 2× average = institutional or retail interest.

Tools to use:

- TradingView Screener

- Finviz Elite

- Webull Movers tab

Why it works: High volume confirms volatility is “real” and not just random movement.

✅ 4. Tight Risk Control with ATR Stops

Use Average True Range (ATR) to set realistic stops.

- Entry at breakout = Stop-loss at 1.5× ATR below

- Avoids getting stopped on normal volatility

This gives your trade room to breathe without taking oversized losses.

✅ 5. Predefined Entry, Exit, and Size Plan

Before any trade:

- Know your entry trigger

- Set a maximum loss (1–2% of account)

- Define target zones (based on resistance or risk-reward ratio)

Planning beats reacting.

What Doesn’t Work in Volatility-Based Day Trading

❌ 1. Chasing Spikes Without Structure

Buying after a stock is already up 10% without a setup leads to:

- Late entries

- Emotional exits

- Sudden reversals

Avoid trades without a technical base or pullback.

❌ 2. Oversizing Positions

Big moves make traders greedy. Oversizing leads to:

- Emotional decision-making

- Freezing when the trade goes against you

- Overreacting to normal pullbacks

Use smaller size with wider stops for volatile names.

❌ 3. Trading Without a Catalyst

A stock can be moving, but without news or a fundamental driver, it’s often:

- Thinly traded

- Easily manipulated

- Lacking follow-through

Trade stocks with earnings, news, or sector momentum.

❌ 4. Holding Through Reversals

Volatility means quick reversals. If your plan was for a day trade:

- Stick to it

- Don’t turn it into a swing trade out of hope

- Set a stop and respect it

Discipline is non-negotiable.

❌ 5. Blindly Using Indicators

Overloading charts with MACD, RSI, Bollinger Bands, etc., doesn’t help. For volatile stocks:

- Price action, volume, and VWAP matter most

- Use minimal indicators to reduce analysis paralysis

FAQs

What’s the best time of day to trade volatile stocks?

The first 90 minutes after the open (9:30–11:00 AM ET) offers the most movement and volume.

Can beginners trade volatile stocks intraday?

Yes, but they should use small positions, defined stops, and simple setups like VWAP pullbacks.

What chart timeframe is best?

Use 1-minute or 5-minute for execution, and 15-minute for overall setup structure.

How do I find the best volatile stocks each day?

Use scanners filtering for % change, volume, and pre-market activity on platforms like TradingView or Webull.

Is paper trading useful for this style?

Yes. Paper trading volatile setups helps build muscle memory without financial risk.